0800 6123 303

Call me back

quick advice about going solar

0800 6123 303

The Feed-in-Tariff (FiT) rate of 12.92 pence per kWh for 20 years is valid from January 2015. Our expectation is that it will remain at 12.92 pence for the rest of 2015. The government pays the FiT through utility companies and the solar panel subsidy is tax-free and inflation adjusted. Because solar panel prices have dropped significantly in the last years, your return on investment is currently just as good now as it was on earlier Feed-in-Tariff rates (of 16p, 21p or 43p). Enter your postcode in the box above to see what your roof can earn with solar panels.

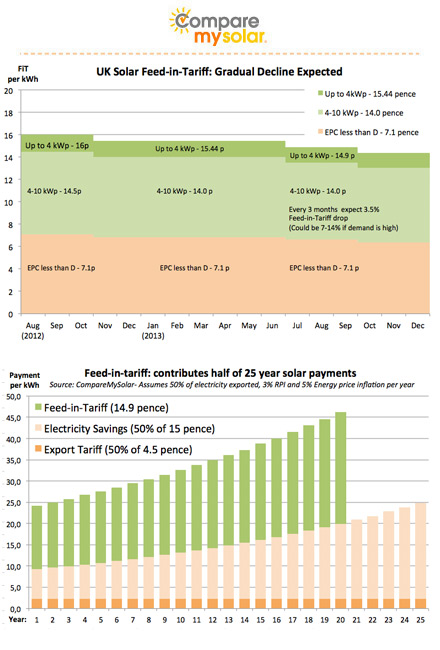

For every kWh generated by your solar panels you will receive the Feed-in-Tariff, which is tax-free, and will rise in line with inflation. The current FiT rate is 12.92 pence per kWh and is valid for 20 years. Larger systems (above 4kWp) will receive a 10% lower rate of 11.71 pence. This Feed-in-Tariff is valid from July 2015 and could gradually be cut every three months after (see first graph for overview):

The most recent drop of half a penny only makes a yearly difference of 15-20 pounds, whereas solar panel prices often vary by hundreds of pounds.

The Feed-in-Tariff is still the largest component of your financial return from solar panels. This is illustrated for year one through this simplified calculation of the total return per kWh generated:

The second graph illustrates the same point over 25 years, but includes an assumption of 3% Retail price inflation for the Feed-in-Tariff and 5% Energy price inflation every year. This clearly shows that despite the cuts the Feed-in-Tariff payments still account for over half your financial return. Enter your postcode in the box above to calculate the financial return for your own roof.

UK Solar Panel Feed-in-Tariffs for 2015